Research Article - (2024) Volume 2, Issue 3

Snowball Effect Strategy for the Innovation of the Korean National Pension System and High Return HyTak ETF

2Kim Hyun-Tak Physics & Applications Lab, Small Hall 154, College of William & Mary, Williamsburg, VA, USA

Received Date: Nov 11, 2024 / Accepted Date: Dec 03, 2024 / Published Date: Dec 13, 2024

Copyright: ©©2024 Hyun Tak Kim. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Citation: Kim, H. T. (2024). Snowball Effect Strategy for the Innovation of the Korean National Pension System and High Return HyTak ETF. Curr Trends Business Mgmt, 2(3), 01-04.

Abstract

Debates in the Korean National Assembly focus on reforming the defined-benefit pension system as the national pension fund is projected to deplete by 2055 due to a failure to maximize returns, as mandated by Paragraph 2, Article 102 of the Korean National Pension Law. Proposals like raising contribution and replacement rates seem insufficient. We advocate maximizing the fund through the snowball effect by investing in exchange-traded funds with high-return, long-term, steadily growing stocks, despite their volatilit. The fund maximum promotes a more humane quality of life by introducing an automatically and steadily increasing system for pension benefits into the government bill aimed at reforming the national pension system, announced on September 4, 2024. Transitioning to a defined-contribution system, similar to the USA’s 401(k), is crucial for sustainability. Additionally, HyTak fund’s’ return rate could exceed a ten-year average annual return of 35%, equivalent to a compound interest rate of 1,910% over 10 years or 40,327% over 20 years.

Keywords

Korean Pension System, Snowball Effect, Exchange-Traded Fund, 401(K), 35% Over Return Rate

Introduction

Despite Korea's impressive and rapid economic growth, the nation has yet to establish a stable and developed pension system. The country, having adopted the defined benefit (DB) retirement pension system, now faces the dual challenges of a declining birth rate and an increasing elderly population. This demographic shift impedes the future growth of the national pension fund, as an aging society swiftly depletes the accumulated resources, placing a significant burden on future generations. As a result, the national pension fund is projected to be depleted by 2055. In the Korean National Assembly, people are intensely debating how to replenish the depleted fund and determine appropriate pension payments to ensure a humane standard of living, as ensured by Article 34 of the Korean Constitution. The depletion stems from a failure to maximize fund returns, as mandated by Paragraph 2, Article 102 of the Korean National Pension Law. Moreover, a lack of transparency and competence in fund management has deepened public distrust. These issues pose significant national challenges that threaten Korea's future progress, making it imperative to find Effective Solution.

On September 4, 2024, in order to extend the depletion years of the pension fund to 2076, the Korean government announced a bill that increases the pension premium from 9% to 12%, the income replacement rate from 40% to 42%, and the return rate from above 4.5% to above 5.5%. However, people have analyzed that the bill does not ensure a humane life as guaranteed by Article 34 of the Korean Constitution. The issue still remains to be addressed.

In contrast, the USA adopted the defined contribution (DC) retirement pension system, originated in Sweden and known as the 401(k), in 1981. This system has since become a staple of American retirement planning. The DC pension system, which does not depend on either a decreasing birth rate or an increasing elderly population, has significantly contributed to the growth of the nation's industry. In the DC system, individuals must select a personal pension portfolio, self-pension plan, or investment products supplied by asset management companies – a hallmark of the democratic system. Personal stocks then become valuable income sources for pensions, though they are classified as risky assets.

In this letter, to address the proposed issue, we suggest maximizing the national fund, as outlined in Paragraph 2, Article 102, through exchange-traded funds (ETFs) composed of long- term, steadily growing stocks. We affirm the applicability of ETFs to the pension system by analyzing prominent ETFs with high returns or significant gains achieved through the snowball effect and examining their volatility during the burst of the COVID-19 bubble. ETFs, which are collections of stocks, provide a safer long- term option and are less volatile due to diversification compared to individual stocks with high long-term volatility.

Volatility Analysis of 10 years ETF Data and Pension Strategy

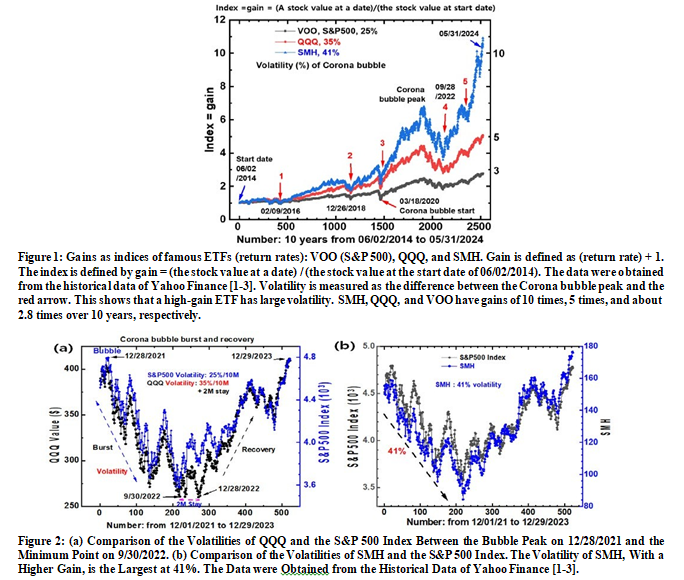

The long-term ETF return rate, which can be regarded as gain, has undergone economic cycles with a negative return rate two or three times in five years, as shown by the red arrows in Fig.

1. To ensure the safety of ETFs, we determine the gains of the pension return rates for VOO, which includes 500 companies and has a 10-year average return rate of approximately 270%; QQQ (Nasdaq 100), which includes 100 companies and has a 10-year average return rate of approximately 500%; and SMH (VanEck Semiconductor), which includes 25 companies and has a 10-year average return rate of approximately 1000% (annual return of approximate 27% in compound interesting rate), as shown in Fig.

1. The high gains are caused by the snowball effect. Note that the return rate is different from the gain, where return rate = gain − 1, and the gain is defined as (the stock value at a date)/(the stock value at the start date).

In exceptional circumstances such as the Corona bubble, ETFs exhibit large volatility, which adversely affects the snowball effect. We investigate the extent of the Corona volatility in prominent ETFs, specifically VOO (S&P 500), QQQ, and SMH, as illustrated in Fig. 2. VOO shows a decreasing volatility of 25% over approximately 10 months, but the decreasing volatility of QQQ is 35%, which is much worse than VOO. SMH, with its higher return rates, displayed about 41%. The behavior of SMH is similar to that of VOO, as displayed in Figure. 2(b).

We present an example of applying the SMH gain to the pension system, assuming that future economic conditions will be similar to those of the past 10 years. If the starting premium for the pension is $1, the snowball effect will increase the premium to $10 after 10 years, assuming a gain of 10 times that of SMH. After 20 years, with the starting premium at $10, the increased premium becomes $10 × 10 = $100. After 30 years, the increased premium becomes $100 × 10 = $1,000. After 40 years, the increased premium becomes $1,000 × 10 = $10,000. At this point, some pension will be paid out, and the balance will be continuously rolled over. After 50, 60, 70, and 80 years, the pension amount will become significantly larger.

Effect of an ETF with Long-Term Steadily Growing Stocks

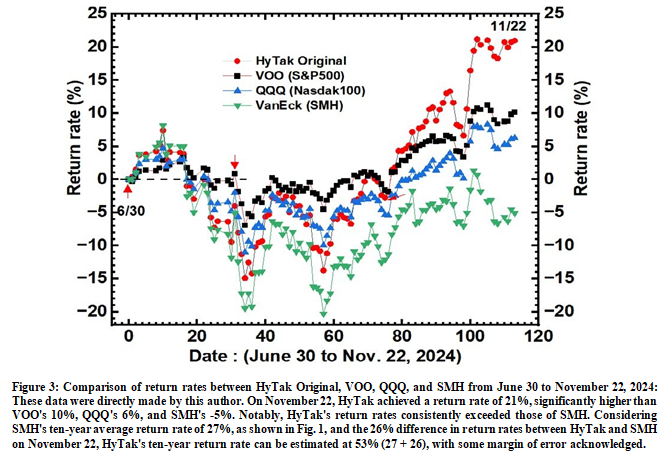

To evaluate the maximization of the return rate of an ETF in accordance with Paragraph 2, Article 102 of the Korean National Pension Law, we present an example comparing the HyTak original ETF with VOO, QQQ, and SMH ETFs. Note that 'HyTak,' omitting 'un' from 'Hyun-Tak,' is the author's name. The HyTak ETF was specifically created to assess the possibility of whether an ETF can achieve maximization. Although it was launched on January 1st, 2022, it was not active during the burst of the COVID-19 bubble between mid-2022 and 2023, as we were beginners at that time. By mid-2024, the portfolio had been completed with about 37 individual stocks, although the total period was approximately three years. A key characteristic of the HyTak ETF is that it was largely composed of long-term, steadily growing stocks, which contributed to its high return rate and maximum snowball effect.

From June 30th, the return rate of the ETF was compared with VOO, QQQ, and SMH over a period of about five months. Although the period is not ten years, we can estimate the ten-year return rate by comparing it with the well-known ten-year reference value of 27% for SMH, as shown in Fig. 1. As of November 22, 2024, the return rate of HyTak with 26% between HyTak and SMH, as shown in Figure. 3, can be 53% (27+26) as a ten-year average annual rate. This suggests that the ten-year average annual return rate of HyTak could exceed 35%(á´Â 53-16) with optimal portfolio adjustments, even when accounting for a difference of 16% between SMH's and VOO’s volatilities (41 - 25 = 16), as shown in Figure. 2, which can align with the requirements of Paragraph 2, Article 102 of the Korean National Pension Law.

Conclusion

As the gain of an ETF increases, its volatility also increases, and vice versa. The monthly pension premium, which is periodically invested in the ETF, mitigates the threat posed by high volatility; the ETF remains stable over the long term, unlike individual stocks. High-yield ETFs such as SPY, VOO, XLK, QQQ, SOXX, SMH, and the in-testing HyTak are available.

For ETFs containing long-term, steadily growing stocks such as HyTak, the pension amount accrued and maximized through the snowball effect can be sufficient to sustain a comfortable life, as guaranteed by Article 34 of the Korean Constitution. The life can be achieved by incorporating a system for automatically and steadily increasing pension benefits into the government bill for reforming the national pension system, announced on September 4, 2024. Korean people must adopt the DC system, which is independent of the challenges posed by a declining birth rate and an aging population, rather than the DB system, which depends on these factors.

We suggest that the maximum return rate of the pension fund could exceed a ten-year average annual return of 35%, equivalent to a compound interest rate of approximately 1,910% over 10 years or 40,327% over 20 years, in accordance with the requirements of Paragraph 2, Article 102 of the Korean National Pension Law. This approach could also be applied to other nations facing similar problems.

References

1. Historical data of VOO in Yahoo Finance.

2. Historical data of QQQ in Yahoo Finance.

3. Historical data of SMH in Yahoo Finance