Research Article - (2025) Volume 3, Issue 2

Determinants of Renewable Energy Investment: An Integrated Analysis of ESG, Geopolitical Risk, and Finance

Received Date: Apr 01, 2025 / Accepted Date: Apr 28, 2025 / Published Date: May 02, 2025

Copyright: ©©2025 Henry Efe Onomakpo. This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited.

Citation: Onomakpo, H. E. O. (2025). Determinants of Renewable Energy Investment: An Integrated Analysis of ESG, Geopolitical Risk, and Finance. J Invest Bank Finance, 3(2), 01-18.

Abstract

The global transition to renewable energy (RE) requires substantial investment amidst complex interactions between Environmental, Social, and Governance (ESG) factors and Geopolitical Risk (GPR). This study investigates these dynamics across 44 countries from 2008-2023 using an integrated panel dataset combining IRENA investment data, World Bank ESG indicators, and the GPR index. Panel data regression models (Pooled OLS, Random Effects, Fixed Effects) with robust clustered standard errors were estimated after addressing multicollinearity via VIF reduction and performing appropriate model selection tests. The Fixed Effects (Entity) model was preferred based on a significant Hausman test (p=0.0000). Results indicated that within-country changes in GPR were not significantly associated with annual RE investment changes (p=0.43). Specific social equity metrics (income share of lowest 20%, Gini index) showed significant associations with investment shifts, while changes in selected governance and environmental indicators did not. Investment composition by technology (e.g., wind, solar, hydro) and financing type (specifically grants, p=0.005) were significant predictors. The findings suggest foundational stability and social equity considerations are critical alongside targeted financial mechanisms for accelerating RE investment, while short-term GPR volatility showed limited direct impact within countries during this period

Keywords

Renewable Energy Investment, Green Finance, ESG, Geopolitical Risk, Panel Data Analysis, Fixed Effects Model, Energy Transition, Sustainable Finance, Investment Drivers

Introduction

The global imperative to transition towards sustainable energy systems is driven by the twin challenges of mitigating climate change and enhancing energy security. Renewable energy (RE) sources, including solar, wind, geothermal, and increasingly, green hydrogen, are central to this transition [1]. Achieving ambitious targets, such as those outlined in the Paris Agreement and various national net-zero commitments, necessitates unprecedented levels of investment in RE infrastructure [2,3]. Concurrently, the investment landscape is increasingly shaped by two powerful forces: the growing emphasis on Environmental, Social, and Governance (ESG) factors in financial decision-making and the persistent volatility introduced by Geopolitical Risk (GPR). Investors, policymakers, and corporations now operate at the confluence of these trends, needing to navigate environmental mandates, social expectations, governance standards, and political instability simultaneously [4,5]. Analyzing the combined influence of these factors on the scale and type of RE investments is vital for speeding up the global energy transition.

While considerable research exists on the individual impacts of ESG performance, geopolitical stability, and specific financing mechanisms on investment outcomes, a significant gap exists in empirically tested knowledge [6-10]. Few studies have formulated and rigorously tested specific hypotheses regarding how these multifaceted drivers collectively influence the scale, composition, and resilience of renewable energy investments across diverse national contexts, particularly when accounting for stable country specific characteristics. Current research frequently isolates factor pairs or geographical areas, thus failing to capture the complex, potentially conditional relationships influencing RE investment globally. Consequently, identifying the key drivers for the required multi-trillion-dollar annual green finance flows remains challenging [2]. This study aims to address the identified gap by comprehensively analyzing the drivers of renewable energy investment across a diverse panel of 44 countries from 2008 to 2023. The primary objectives are:

• To assess the individual and combined influence of country-level ESG performance indicators and Geopolitical Risk on the total amount of committed renewable energy investment, particularly focusing on within-country variations over time.

• To examine how different components of ESG (Environmental, Social, Governance) relate differently to investment patterns within countries.

• To understand the role of investment composition, including specific sub-technologies and financing types, in explaining within-country changes in overall investment levels.

• To evaluate the suitability of different panel data econometric models for analyzing these relationships and provide methodologically sound insights.

To achieve these objectives, this study formulates and tests the following specific hypotheses regarding the drivers of renewable energy investment, primarily focusing on within-country dynamics assessed via Fixed Effects models:

• H01 : Within-country changes in geopolitical risk have no statistically significant association with changes in renewable energy investment when controlling for other factors.

• Ha1 : Within-country changes in geopolitical risk are statistically significantly associated with changes in renewable energy investment when controlling for other factors.

• H02 : Within-country changes in various ESG dimensions (including governance indicators, social equity metrics, and environmental performance proxies) are not statistically significantly associated with changes in renewable energy investment, controlling for other factors.

• Ha2 : Within-country changes in at least some ESG dimensions (including governance indicators, social equity metrics, and environmental performance proxies) are statistically significantly associated with changes in renewable energy investment, controlling for other factors

• H03 : Within-country variations in the amounts invested in specific sub-technologies and the use of specific financing instruments (like grants) are not statistically significantly associated with within-country variations in the total renewable energy investment amount.

• Ha3 : Within-country variations in the amounts invested in specific sub-technologies and/or the use of specific financing instruments (like grants) are statistically significantly associated with within-country variations in the total renewable energy investment amount.

This research offers several contributions, academically, it provides one of the first integrated empirical analyses combining comprehensive ESG data, GPR, and detailed renewable energy investment data (including financing types and technologies) in a cross-country panel setting, specifically testing hypotheses about within-country drivers. It contributes methodologically by applying and comparing panel econometric models after robust preprocessing (interpolation, VIF) and rigorous model selection (Hausman test). For policy, by testing specific hypotheses, the f indings offer empirical evidence on which ESG factors (e.g., social equity metrics) demonstrate the strongest statistically significant association with changes in RE investment within countries, providing potential levers for policy intervention. The results provide empirical evidence regarding the hypothesized (lack of) direct impact of GPR volatility on investment changes within countries, distinct from baseline country risk. The evidence regarding the significance of specific financing types (like grants) can inform the design of effective support mechanisms. Ultimately, the study provides investors and project developers with empirical insights into the complex risk landscape, highlighting the demonstrable link between changes in specific ESG factors and investment trends, which can inform risk management and portfolio allocation strategies focused on within-country dynamics.

Material and Method

This study employed a quantitative panel data approach to analyze the drivers of renewable energy investment across multiple countries over time, focusing on the interplay between ESG factors and geopolitical risk.

Data Sources and Sample Construction

The analysis utilized an unbalanced panel dataset constructed from three primary sources, covering 44 countries for the period 2008 2023.

For “Renewable Energy Investment”, annual country-level investment data (amount_usd_million), including details on sub-technology and financing types, were obtained from the International Renewable Energy Agency (IRENA) statistics database [1]. Meanwhile, for the “ESG Indicators”, comprehensive country-level Environmental, Social, and Governance (ESG) indicators (e.g., control of corruption, political stability, energy intensity, poverty rates, access to services) were sourced from the World Bank Databank's Environment, Social and Governance collection [11]. Ultimately, for the “Geopolitical Risk”, the annual country-specific Geopolitical Risk (GPR) index, developed by, was retrieved from the World Bank database [12,13].

Variable Description

The dependent variable is the Total annual renewable energy investment amount (amount_usd_million) in millions of US dollars. Whereas, for the independent variables, the primary predictors included the Geopolitical Risk index and various indicators representing the E, S, and G dimensions from the World Bank database. Variables derived from the IRENA data detailing counts or the presence of specific sub-technologies and f inance types were also included initially to control for investment composition effects before VIF analysis. (A detailed variable list is provided in Table 2).

Data Preprocessing

The raw ESG data required specific parsing due to its initial format, followed by transformation into a standard panel structure (Country x Year). Datasets were merged based on country and year identifiers. A left join was used for the investment data to retain all country-year observations from the merged ESG-GPR dataset. Missing values in the ESG/GPR indicators were imputed using a panel-aware strategy combining linear interpolation and median filling within each country group, followed by global median filling for any remaining gaps. Missing investment-related variables resulting from the left join were imputed with zero.

Statistical Analysis and Modeling Strategy

Before model estimation, multicollinearity among the independent variables was assessed using the Variance Inflation Factor (VIF) calculated via the statsmodels library [14]. Variables with a VIF exceeding 10 were iteratively removed to ensure model stability. Panel data regression techniques were employed to estimate the relationship between the dependent variable and the VIF-screened independent variables, controlling for unobserved heterogeneity. Pooled OLS, Random Effects (RE), and Fixed Effects (FE - Entity) models were estimated using the linearmodels library in Python [15]. Robust standard errors clustered at the country level were utilized in all models to account for potential heteroskedasticity and serial correlation. Model selection between Pooled OLS, RE, and FE was guided by standard diagnostic tests. An F-test assessed the joint significance of fixed effects (comparing FE vs. Pooled OLS), and the Hausman test was used to evaluate the consistency of the RE model by testing for correlation between unobserved entity effects and regressors (comparing FE vs. RE).

Software and Tools

Data processing, analysis, and visualization were primarily conducted using Python (version 3.11). Key libraries included pandas for data manipulation, numpy for numerical operations, statsmodels and linearmodels for econometric modeling and diagnostics, scipy for statistical tests

Results

This section presents the comprehensive literature review and the empirical findings derived from the panel dataset spanning 44 countries from 2008 to 2023.

Theoretical Framework and Literature Review: Institu tional Theory as an Overarching Framework

Understanding the drivers and complexities of renewable energy (RE) investment requires acknowledging the institutional environment in which financial decisions are made. Institutional Theory provides a robust lens for this, emphasizing how organizations (investors, firms, and governments) conform to societal norms, rules, and cognitive frameworks to gain legitimacy and resources [16]. In the context of green finance, institutional pressures coercive (regulations, policy mandates), normative (professional standards, social expectations), and mimetic (copying successful peers) shape investment behavior [17-20]. Coercive pressures include climate policies, environmental regulations, carbon pricing mechanisms, and mandates for sustainable f inance disclosure [21,22]. For instance, government actions like environmental taxes can significantly impact renewable energy investment (REI), forcing firms to internalize externalities [23]. International agreements like the Paris Agreement exert coercive pressure on nations and, consequently, on their financial institutions [24].

Normative pressures arise from evolving societal expectations and industry norms regarding sustainability and corporate social responsibility (CSR). The increasing demand for ESG (Environmental, Social, Governance) considerations in investment portfolios reflects this normative shift [6]. Financial institutions and investors adopt green finance practices not only due to regulation but also to align with ethical standards and stakeholder demands for responsible investing [25]. Mimetic pressures drive organizations to imitate the strategies of perceived successful or legitimate actors, especially under uncertainty [16]. The rapid diffusion of green bonds, for example, can be partly explained by institutions mimicking pioneers like the World Bank or EIB [9]. Similarly, the adoption of specific renewable energy technologies or investment strategies by private equity firms in emerging markets like India may involve mimetic processes as investors observe and replicate successful models [26].

ESG and Renewable Energy Financing The link between ESG performance and financing for renewable energy is increasingly central. Institutional Theory suggests that strong ESG performance enhances organizational legitimacy, potentially easing access to capital. Empirical evidence supports this, showing that ESG performance can influence investment decisions and financial flows toward cleaner energy [4].

Green f inance mechanisms, intrinsically tied to ESG principles, are designed to channel capital specifically towards environmentally beneficial projects, including renewables [7]. However, the relationship is complex. While green finance is intended to promote environmental sustainability, its effectiveness can be debated, sometimes necessitating trade-offs with purely financial returns or facing implementation challenges, particularly concerning risk perception [22,27]. Furthermore, factors like institutional quality and economic development moderate the impact of ESG and green f inance on actual renewable energy deployment [4]. Research suggests that while green finance facilitates REI, complementary policies like environmental taxes and robust governance frameworks are crucial for maximizing its environmental impact [23]. The focus on ESG is also driven by investor impact considerations, where shareholders use engagement and capital allocation to steer companies towards better environmental practices [6].

Geopolitical Risk and Investment Behavior

Geopolitical Risk (GPR), encompassing factors like political instability, conflict, sanctions, and resource volatility, significantly shapes the investment landscape, particularly for capital-intensive energy projects [28]. Institutional Theory helps understand GPR's impact; high instability creates regulatory uncertainty (coercive dimension) and undermines normative expectations of stable business environments, discouraging long-term commitments. Empirically, GPR exhibits complex relationships with energy assets. Studies show GPR negatively impacts carbon market prices and ESG-focused stocks in markets like China, suggesting investors perceive a higher risk for environment-related assets during turmoil [8]. However, the relationship with clean energy stocks can be nuanced; while some studies find negative impacts, others suggest clean energy can benefit during crises as countries seek energy independence [28].

The Russia-Ukraine conflict, for instance, intensified spillover dynamics between energy markets [29]. GPR also influences volatility, often amplifying uncertainty in energy markets [8]. The consensus, supported by theory and empirical findings, suggests that higher political stability fosters greener growth and investment, while external conflict risk can hinder environmental transitions, although short-term dynamics might vary [30,31]. Studies focusing on specific developing regions highlight how perceived policy instability and high costs of capital, often linked to broader geopolitical or country-specific risks, create a “climate investment trap,” hindering necessary green finance flows [32].

Financing Mechanisms and Technological Differentiation

The financing landscape for renewable energy is diverse, involving a mix of public and private capital channeled through various instruments. Key mechanisms include Public-Private Partnerships (PPPs), which are collaborations that leverage private-sector expertise and capital alongside public-sector oversight and risk mitigation for large-scale infrastructure projects. They can be crucial for de-risking complex or first-of-a-kind RE technologies, although their specific structures vary significantly. Bonds (particularly Green Bonds) are a type of debt security that is used to obtain finance for environmental projects. The green bond market has grown rapidly, owing to investor demand for sustainable assets and increased standardization initiatives [33]. They provide an important channel for institutional capital (pension funds and insurance firms) into real estate. Their resilience to exogenous shocks, like as oil price volatility, varies with country and market conditions [34]. Meanwhile, Equity (Private & Public) includes venture capital, private equity, and investments in publicly listed clean energy companies. Private equity plays a critical role in scaling up developer platforms, particularly in emerging markets like India, often seeking higher risk-adjusted returns through active management and specific investment strategies [26].

Publicly traded clean energy stocks offer liquidity but are subject to broader market volatility and investor sentiment [35,36]. Impact investors are investors who prioritize measurable social and environmental impact alongside financial returns. They may provide crucial early-stage funding or patient capital for innovative RE technologies or projects in underserved markets, often bridging the gap left by traditional finance [6]. Grants are non repayable funds from governments, international organizations (like development banks), or foundations. Grants are often vital for research, development, demonstration projects, capacity building, or making projects viable in challenging markets, particularly in developing economies [3]. They directly reduce project costs and risks. Furthermore, traditional debt financing from banks or specialized institutions (e.g., development finance institutions). Loan availability and cost are influenced by project risk, counterparty creditworthiness, policy stability, and broader f inancial market conditions [32].

Green loans with specific environmental covenants are an emerging category. Meanwhile, tax Incentives are used as Government policies to reduce tax burdens for Renewable Energy investments or production (e.g., Investment Tax Credits, Production Tax Credits). These directly improve project economics and incentivize private investment by increasing post-tax returns [23]. Their design and stability are crucial for investor confidence. Ultimately, Fintech, which is financial technology, is emerging as a facilitator, potentially reducing transaction costs, increasing transparency (e.g., via blockchain for green bond tracking), and creating new platforms for crowdfunding or peer-to-peer lending for smaller RE projects [10,37]. Connecting with Asset Pricing Theory and Portfolio Diversification, each financing mechanism presents a distinct risk-return profile, influenced by technology type, project stage, policy environment, and GPR. Asset Pricing Theory helps frame how these risks (e.g., policy risk, technology risk, operational risk, counterparty risk associated with loans or PPPs) are priced by investors [38]. For instance, government grants or tax incentives effectively lower the risk and required return for private investors, while equity investments bear higher risk but offer potential upside. Green bonds may offer lower returns but are perceived as lower risk compared to conventional bonds or equity, attracting specific investor types [33]. From a Portfolio Diversification perspective, investors strategically combine these mechanisms and associated technologies.

A portfolio might balance established technologies (solar/ wind) financed via bonds/loans with higher-risk/higher-reward investments in hydrogen or marine energy financed through equity or blended structures involving PPPs and grants [39]. The effectiveness of specific assets as hedges or safe havens during crises is critical; gold and Bitcoin offer diversification against some green assets, while within the green space, certain sub-sectors like Wind/Geothermal might provide internal hedging benefits [40,41]. The interaction between conventional energy prices (like oil) and green finance instruments (like green bonds) further highlights diversification and hedging opportunities [34,35]. The structure of finance (e.g., reliance on international loans vs. domestic bonds) can also influence vulnerability to global financial stress or policy uncertainty [32]. Fintech potentially alters diversification opportunities by enabling fractional ownership or access to previously inaccessible project types [10].

Research Gap

The literature reveals significant progress in understanding the distinct roles of ESG factors, geopolitical risk (GPR), and various f inancing mechanisms in the renewable energy sector. Frameworks like Institutional Theory explain the adoption of practices and norms, while Asset Pricing and Portfolio theories offer lenses for analyzing the associated risk-return dynamics. However, significant gaps remain for a holistic understanding. Key limitations include the lack of integrated models observed as existing research often examines drivers in isolation. There is a pressing need for models that simultaneously capture the dynamic interplay between ESG considerations, GPR fluctuations, the specific characteristics of different financing instruments, and deployment outcomes across distinct renewable energy technologies. For mechanism or technology effectiveness, the relative effectiveness and suitability of financing mechanisms (e.g., green bonds vs. private equity vs. Fintech platforms) for specific technologies (e.g., established solar vs. nascent hydrogen vs. capital-intensive geothermal) under varying geopolitical and market conditions require more robust empirical investigation. While portfolio diversification logic applies conceptually to green investments, further research is needed on how institutional investors and policymakers practically navigate this, considering real-world constraints, institutional pressures, and varying risk profiles of green assets [18,41].

For causality and dynamics, understanding the causal pathways and feedback loops between these factors, potentially through advanced time-series, network analysis, or other sophisticated methods, remains underdeveloped [39,41]. Meanwhile, geographical scope and predictability depict that much analysis concentrates on specific regions or developed markets [8,26,31]. Broad cross-country panel analyses incorporating diverse institutional contexts are less common. Furthermore, recent attempts at prediction highlight potential dynamic instability and the challenges in forecasting RE investment based solely on historical ESG/GPR data. Specifically, the primary gap this study addresses is the lack of integrated, cross-national empirical frameworks modeling the simultaneous influence of ESG performance, external geopolitical stability, and the detailed structure of finance (mechanisms and technologies) on renewable energy investment levels. Prior studies often focus on pairs of these dimensions but not their combined, interactive effects across a diverse global sample [7,28,4]. This study aims to address this central gap by developing and estimating an integrated panel data model incorporating comprehensive ESG indicators, the Geopolitical Risk Index, and detailed renewable energy f inancing data (including technology and financing types) across 44 countries over the period 2008-2023. This approach allows for exploring the conditional impacts and relative importance of these factors in shaping the global renewable energy investment landscape.

Assessment of Multicollinearity, Panel Model Estimation and Selection

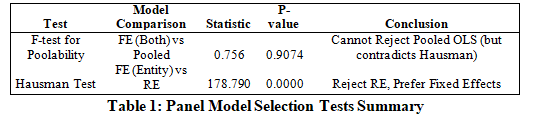

Before model estimation, potential multicollinearity among explanatory variables was assessed using the Variance Inflation Factor (VIF). Variables exhibiting VIF values exceeding the commonly accepted threshold of 10 were iteratively removed. This process continued until all remaining predictor variables included in the final models demonstrated VIF values below this threshold, indicating that multicollinearity was adequately addressed and allowing for a more reliable interpretation of the regression coefficients. To investigate the relationship between ESG factors, geopolitical risk, financing structures, and renewable energy investment (amount_usd_million), several panel regression models were estimated: Pooled OLS, Random Effects (RE), Fixed Effects controlling for entity (country) heterogeneity (FE-Entity), and Fixed Effects controlling for both entity and time heterogeneity (FE-Both). Robust clustered standard errors were employed in all estimations to account for potential heteroskedasticity and serial correlation within countries. The primary results of these models and associated specification tests are summarized in Table 1 (Model Selection Tests). The Pooled OLS model, which does not account for panel-specific effects, yielded an overall R-squared of 0.8766. The Random Effects model produced numerically similar coefficient estimates and overall fit statistics. However, the critical Hausman test comparing the Fixed Effects (Entity) model against the Random Effects model yielded a highly significant result (Chi2(65) = 178.79, p = 0.0000; see Table 1). This strongly rejects the null hypothesis of no correlation between the unobserved country-specific effects and the included regressors, indicating that the Random Effects model produces inconsistent estimates and that a Fixed Effects specification is statistically preferred.

The F-test comparing the Fixed Effects (Entity and Time) model against Pooled OLS yielded a non-significant p-value (p = 0.9074), suggesting that adding both entity and time effects simultaneously did not provide a statistically significant improvement over the simple Pooled model in this specific joint test. Given the decisive Hausman test result favoring FE over RE due to indicated endogeneity, the Fixed Effects (Entity) model was selected as the most appropriate specification for primary interpretation, controlling for time-invariant country characteristics. The Fixed Effects (Entity) model exhibited a within R-squared of 0.7908.

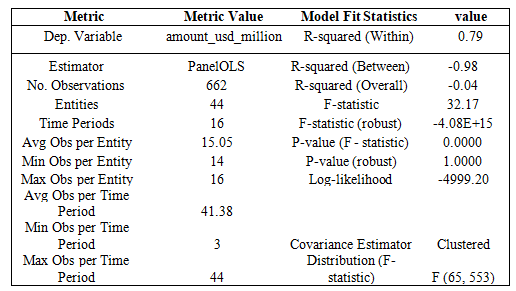

Econometric Results: Preferred Model (Fixed Effects -Entity)

The model fit statistics for the preferred Fixed Effects (Entity) model are presented in Table 2. The within R-squared was 0.7908, indicating that the model explains approximately 79.1% of the variation in renewable energy investment within countries over the study period, after controlling for fixed country-specific characteristics.

Table 2: Fixed OLS Results (VIF-Reduced, Clustered SE) - Model Summary

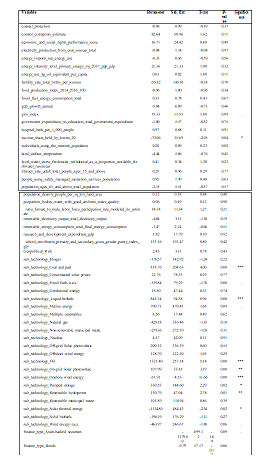

The detailed coefficient estimates for this preferred Fixed Effects (Entity) model are shown in Table 3.

Table 3: Preferred Panel Model Results (Fixed Effects - Entity) by Hausman Test

Analysis of the coefficients in Table 3 reveals several statistically significant associations within the Fixed Effects model. The variable income_share_held_by_lowest_20 showed a significant negative relationship with investment (p = 0.041), while gini_ index had a borderline significant positive relationship (p = 0.094). Geopolitical_Risk (p = 0.434) and various other ESG indicators, including control_corruption_estimate (p=0.105), poverty_ headcount_ratio... (p=0.570), and population_ages_65_and_ above... (p=0.567), were not found to be statistically significant predictors of within-country changes in renewable energy investment. Investment composition significantly explained the total investment amount, with strong positive coefficients for several sub-technologies, notably sub_technology_Liquid biofuels (p=0.0000), sub_technology_Oil (p=0.0000), sub_technology_ Onshore wind energy (p=0.0000), sub_technology_On-grid Solar photovoltaic (p=0.0015), sub_technology_Renewable hydropower (p=0.0056), sub_technology_Coal and peat (p=0.0001), and sub_ technology_Pumped storage (p=0.0226). A significant negative coefficient was observed for sub_technology_Solar thermal energy (p=0.0195). Among financing types, finance_type_Reimbursable grant was significantly positive (p=0.0053).

Econometric Results: Pooled OLS Model

A Pooled Ordinary Least Squares (OLS) regression was initially performed to examine the cross-sectional and time-series associations between renewable energy investment (amount_usd_ million) and the independent variables, treating all observations equally without

Table 4: Pooled Effects (Country) Results (Clustered SE) - Model Summary

The Pooled OLS model results, presented in Table 4, indicate an overall R-squared of 0.88, suggesting a high degree of association between the included independent variables and the dependent variable (amount_usd_million) when ignoring the panel structure. Several variables exhibited statistical significance at conventional levels in this specification. Specifically, income_ share_held_by_lowest_20 (p=0.02**) showed a significant negative association with investment amount. Variables related to access to basic services, people_using_safely_managed_drinking_ water_services_population (p=0.08*) and people_using_safely_ managed_sanitation_services_population (p=0.07*), were marginally significant, suggesting potential links between basic infrastructure/development levels and investment, although the signs differed. Energy_intensity_level_primary_energy_mj_2017_ ppp_gdp (p=0.07*) and land_surface_temperature (p=0.10*) were also marginally significant.

Consistent with expectations, several variables representing specific technology investments (such as sub_technology_Coal and peat, sub_technology_Liquid biofuels, sub_technology_Oil, sub_technology_On-grid Solar photovoltaic, sub_technology_ Onshore wind energy, sub_technology_Pumped storage, sub_ technology_Renewable hydropower, and sub_technology_Solar thermal energy with p < 0.01***) and financing types (such as finance_type_Reimbursable grant with p<0.001***) were highly significant predictors of the total investment amount. The primary variable of interest, Geopolitical_Risk, was not statistically significant in this model (p=0.21).

Econometric Results: Random Effects (RE) Model

A Random Effects (RE) model was estimated to assess the relationships while allowing for time-invariant unobserved country heterogeneity assumed to be uncorrelated with the explanatory variables. The results are presented in Table 5.

Table 5: Random Effects Results (Clustered SE) - Parameter Estimates

The Random Effects (RE) model estimation results are provided in Table 5. This model assumes that unobserved country-specific factors influencing renewable energy investment are not correlated with the included explanatory variables. The overall R-squared for the RE model was 0.88, identical to the Pooled OLS model, suggesting that the variables included explain a large portion of the overall variance in investment amounts across countries and time. In this specification, several ESG and economic indicators showed borderline significance (p < 0.10). Specifically, higher energy_ intensity_level_primary_energy_mj_2017_ppp_gdp (p=0.07), lower land_surface_temperature (p=0.10), lower access to people_ using_safely_managed_drinking_water_services_population (p=0.08), and higher access to people_using_safely_managed_ sanitation_services_population (p=0.07) were associated with investment levels. Higher inequality (gini_index, p=0.10) was also positively associated with investment, while a higher income_ share_held_by_lowest_20 was significantly negatively associated (p=0.02**). Geopolitical_Risk (p=0.21) was not statistically significant in the RE model.

Consistent with the Pooled OLS findings, many variables representing specific renewable energy technologies (e.g., sub_ technology_coal and peat, sub_technology_Liquid biofuels, sub_technology_oil, sub_technology_On-grid Solar photovoltaic, sub_technology_Onshore wind energy, sub_technology_ Pumped storage, sub_technology_Renewable hydropower, sub_technology_Solar thermal energy) and financing types (e.g., finance_type_Reimbursable grant) were highly significant (p<0.01***). However, as indicated by the Hausman test results presented previously (Table 4), the core assumption of the Random Effects model (uncorrelatedness between entity effects and regressors) was strongly rejected (p=0.0000). This suggests that the RE coefficient estimates are likely biased and inconsistent, making the Fixed Effects model a more appropriate choice for concluding the relationships between the explanatory variables and renewable energy investment in this dataset.

Discussion

This study investigated the complex interplay between ESG factors, geopolitical risk (GPR), financing structures, and renewable energy (RE) investment across 44 countries from 2008 to 2023. By employing a Fixed Effects panel regression model, selected based on rigorous specification testing (Table 1), the analysis primarily focused on identifying drivers of within-country changes in RE investment over time, controlling for time-invariant national characteristics.

Interpretation of Findings and Hypotheses Revisited

The results offer several key insights into the drivers of RE investment dynamics and allow for an assessment of the study's hypotheses:

H1: Geopolitical Risk and Investment Changes: Analysis using the Fixed Effects model revealed no statistically significant connection (p=0.43, Table 3) between year-to-year changes in the Geopolitical Risk Index within a country and shifts in its total RE investment. Consequently, the null hypothesis (H01) was not rejected. This implies that, while the level of geopolitical stability likely influences a country’s baseline attractiveness for investment (captured implicitly by the fixed effects), year-to-year fluctuations in GPR, as measured by the index, did not demonstrably drive corresponding shifts in aggregate RE investment commitments within countries during the study period, once other factors are controlled. This finding nuances studies focusing on GPR’s impact on more volatile financial assets, suggesting that longer- term, large-scale infrastructure investment decisions might be less sensitive to short-term GPR index volatility compared to underlying institutional stability or specific policy signals [8]. It is also possible that the aggregate GPR index doesn’t fully capture the specific risks (e.g., expropriation risk vs. conflict risk) most pertinent to RE investors.

H2: ESG Dimensions and Investment Changes: The results provided partial support for the alternative hypothesis (Ha2), revealing a differential impact of various ESG dimensions.

For “Governance vs. Environmental Roles”, contrary to expectations that stronger governance would drive increases in investment, changes in control_corruption_estimate (p=0.11) were not significant in the FE model. Similarly, changes in environmental proxies like electricity_production_from_coal. (p=0.97) or energy_intensity. (p=0.32) were insignificant. This suggests that within-country improvements (or deteriorations) in these specific measured governance and environmental indicators, over and above a country’s fixed baseline characteristics, did not translate directly into significant yearly shifts in aggregate RE investment during this period. This aligns partially with Sharipov, who noted the moderating role of development and institutional quality, implying baseline levels might be more critical than marginal changes for aggregate flows [4]. It may also indicate lags in the effect of policy or performance changes on large investment decisions.

In contrast, social equity metrics showed significant associations. Higher income_share_held_by_lowest_20 was associated with lower investment (p=0.04*), while higher inequality (gini_index) was marginally associated with higher investment (p=0.09). This complex finding (rejecting H02 for these variables in favor of Ha2) potentially points towards large-scale RE investments, which dominate the total amount_usd_million, being facilitated in contexts with higher capital concentration rather than directly implying inequality is “good” for RE. It highlights a potential tension between maximizing aggregate investment volume and achieving broader social equity goals within the energy transition that requires further investigation and careful policy design [25].

H3: Investment Composition and Investment Amount: The null hypothesis (H03) was strongly rejected. As depicted the "Resilience and Role of Financing/Technology", has a high statistical significance of numerous sub technology_ variables (***p<0.01 for Liquid Biofuels, Oil likely related to biofuels/feedstock, Onshore Wind, Solar PV, Hydropower, Coal/Peat likely co-firing/ biomass mix, Pumped Storage; **p<0.05 for Solar Thermal “negative”) confirms that the type of technology dominates year-to-year changes in the total reported investment amount (Table 3). This highlights that the aggregate investment figure is heavily influenced by the capital intensity and deployment scale of prevailing technologies (e.g., large wind farms vs. distributed solar). This aligns with portfolio perspectives suggesting assets have distinct characteristics [36].

Among financing types, the finance_type_Reimbursable grant was significantly positive (p=0.005**), supporting Ha3 and highlighting the tangible impact of grants in boosting measurable investment, likely by de-risking projects [3]. The borderline negative significance of finance_type_asset-backed securities (p=0.09) and finance_type_subordinated loan (p=0.07) might reflect specific market conditions or risk perceptions associated with these instruments during the period, deserving further study. The overall pattern suggests that while diverse instruments exist, grants have a particularly discernible impact on changes in aggregate annual figures within countries [5,33].

Policy Implications

The findings, particularly from the statistically preferred Fixed Effects model, suggest several policy implications, like prioritizing foundational stability while managing short-term GPR fluctuations might have limited direct impact on yearly changes in aggregate RE investment based on this model, ensuring fundamental political stability and strong baseline governance institutions remains critical for attracting RE capital initially (supported by, and the logic behind using FE models) [30]. Furthermore, it is important to integrate Social Equity into the RE Strategy. The counter- intuitive findings regarding income share and the Gini index suggest that policies solely focused on maximizing aggregate RE investment might overlook or even exacerbate social inequalities. Policymakers should consider complementary measures (e.g., targeted support for community projects and equitable benefit- sharing mechanisms) to ensure a just energy transition, aligning green finance with broader SDGs [25].

For the Strategic Use of Financing Instruments, there is a significant positive impact of grants, highlighting their effectiveness, particularly for enabling projects or supporting specific technologies. Governments and development agencies should continue leveraging grants strategically, possibly focusing them on nascent technologies (like green hydrogen, which was not distinctly captured here) or overcoming barriers in specific market segments [3]. Encouraging market development for instruments like green bonds remains important for scaling, even if their specific impact on year-to-year change wasn't isolated in the FE model. Risk-adjusted support tailored to technology maturity (e.g., de-risking hydrogen via PPPs or guarantees vs. supporting mature solar/wind via auctions or tax incentives) is essential [9,42,21,26].

Ultimately, for the ESG Data for Policy, while marginal yearly changes in some common ESG metrics didn't strongly predict changes in investment within the FE model, this doesn't diminish their overall importance. ESG factors likely influence the baseline investment climate (country fixed effect) and are critical for attracting normative-driven investors [6]. Policies should continue to promote ESG transparency and performance, focusing on robust governance and potentially specific, impactful social and environmental targets.

Contribution to Theory and Methodology

This study pioneers an integrated empirical analysis combining diverse ESG dimensions, GPR, and granular RE investment data (technology/finance type) within a cross-country panel framework. Moving beyond dyadic relationships, it offers a more holistic view of the complex factors shaping RE investment. Methodologically, it demonstrates the importance of rigorous panel techniques. The Hausman test decisively favoured Fixed Effects over Random Effects, highlighting the presence of endogeneity related to unobserved country characteristics and validating the FE approach for isolating within-country dynamics. The use of robust clustered standard errors addresses common panel data issues. Institutional Theory provides context-specific evidence. The findings suggest that while institutional pressures matter, their measurable impact on annual investment changes might differ across pressure types (e.g., potential social equity norms showing significance vs. some governance score changes not showing immediate significance in the FE model). It reinforces the idea that stable underlying institutions are critical for legitimacy and investment. Meanwhile, sustainable finance and risk resilience empirically confirm the significant role of investment composition (technology and finance type) in determining overall investment, aligning with portfolio concepts. It contributes nuance to the ESG debate by identifying specific social equity factors significantly associated with within- country investment changes. Crucially, it challenges assumptions about the direct, immediate impact of GPR volatility on within- country investment shifts, suggesting resilience or lagged effects might be present, differentiating from GPR's likely impact on initial cross-country allocation decisions. The effectiveness of grants supports theories on de-risking mechanisms in development finance.

Limitations and Future Research

While this study provides valuable insights through its integrated panel analysis, several limitations should be acknowledged, which also point towards avenues for future research. The reliance on country-level aggregate data inherently masks potential heterogeneity at the subnational, firm, or individual project level, where investment decisions are ultimately made. Further research exploring these dynamics at a more granular level could reveal significant variations obscured by national averages. Additionally, ESG data, despite efforts towards standardization, can still possess subjectivity and face challenges in cross-country comparability and consistent measurement over time. The Geopolitical Risk index captures overall risk perception but may not fully differentiate between specific risk types (e.g., policy instability vs. outright conflict) that could have distinct impacts on investor behavior. Data availability also constrained the period and country sample, resulting in an unbalanced panel.

Methodologically, while panel regression identifies significant associations, establishing definitive causality requires more advanced techniques such as instrumental variables, dynamic panel models (e.g., GMM), or specific quasi-experimental designs, which were beyond the scope of this analysis. The insignificant direct effect of GPR fluctuations within countries found here might also stem from lagged impacts not fully captured at an annual frequency or indirect effects via the cost of capital or policy uncertainty, suggesting avenues for exploring dynamic specifications. Furthermore, investigating potential spatial dependencies and network effects, if cross-sectional dependence is confirmed, could offer richer insights using spatial econometrics or network analysis approaches [4,32,39,41]. Future research could also benefit from deeper dives into specific high-potential technologies, such as green hydrogen, or novel financing innovations like Fintech platforms and dedicated impact investing vehicles [10,37,43]. Given the demonstrated limitations of standard machine learning models in predicting out-of-sample investment levels in this context, exploring time-series-specific forecasting models or approaches incorporating dynamic policy variables and structural break detection could yield more reliable predictive insights. Finally, complementing quantitative analyses with qualitative case studies would provide valuable context and a richer understanding of investor decision-making processes under complex institutional pressures and perceived risks inherent in the renewable energy sector [18,37].

Conclusion

This research investigated the complex drivers of renewable energy (RE) investment across 44 countries from 2008 to 2023 by integrating ESG indicators, Geopolitical Risk (GPR), and detailed investment data within a panel Fixed Effects framework. The analysis revealed that year-to-year changes in GPR were not significantly associated with within-country changes in RE investment. However, certain ESG dimensions, specifically social equity metrics like income distribution, showed statistically significant, albeit complex, relationships. Governance and environmental indicators, as measured in this study, did not exhibit significant associations with yearly investment shifts within countries. The study strongly confirmed that the composition of investment across specific technologies and the use of particular financing mechanisms, notably reimbursable grants, are significant factors explaining variations in total RE investment levels. Key recommendations arising from this study center on recognizing the multifaceted nature of RE investment drivers.

Policymakers are advised to prioritize foundational political and institutional stability, integrate social equity considerations into RE deployment strategies to ensure a just transition, and strategically utilize financial tools like grants while fostering a diverse financing ecosystem. Investors should conduct holistic risk assessments that consider baseline country stability alongside dynamic ESG factors (particularly social dimensions), recognize the influence of technology mix on overall investment trends, leverage portfolio diversification, and capitalize on available policy support mechanisms. The global shift to renewable energy unfolds against a backdrop of interconnected environmental pressures, societal demands, governance challenges, and geopolitical instability. This study highlights that successfully scaling green finance requires more than just innovative financial products; it necessitates stable institutions, careful consideration of social impacts alongside environmental goals, and an understanding of how diverse factors interact within specific national contexts. Integrating these complex dynamics into both research and decision-making is essential for navigating the path towards a sustainable and secure energy future effectively and equitably [44-68].

Conflict of Interest

The author declares that there are no conflicts of interest.

Author Contributions

Henry Efe Onomakpo Onomakpo: Conceptualization, Methodology, Software, Data Curation, Formal Analysis (Panel Data Regression), Investigation (Literature Review), Writing - Original Draft.

Funding

This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Acknowledgments

The author thanks the staff of the Faculty of Economics and

Business for their support during the preparation of this manuscript.

Data Availability Statement

The Python script used for the panel regression analysis, an anonymized version of the dataset, and key regression outputs supporting the findings of this study will be made available as supplementary material on the publisher’s website upon publication. This aligns with open science principles promoting transparency and reproducibility.

References

1. International Renewable Energy Agency (IRENA). (n.d.). Renewable energy statistics.

2. Hafner, S., Jones, A., Anger-Kraavi, A., & Pohl, J. (2020). Closing the green finance gap–A systems perspective. Environmental Innovation and Societal Transitions, 34, 26 60.

3. Kerr, S., & Hu, X. (2025). Filling the climate finance gap: holistic approaches to mobilise private finance in developing economies. npj Climate Action, 4(1), 16.

4. Sharipov, K., Abdullayev, I., Kuziboev, B., Makhmudov, S., Kalandarov, F., Khaytboeva, N., & Ilkhamova, Z. (2025). The Effect of Energy Policy Risk on Renewable Energy. International Journal of Energy Economics and Policy, 15(2), 566-575.

5. Babic, M. (2024). Green finance in the global energy transition: Actors, instruments, and politics. Energy Research & Social Science, 111, 103482.

6. Kölbel, J. F., Heeb, F., Paetzold, F., & Busch, T. (2020). Can sustainable investing save the world? Reviewing the mechanisms of investor impact. Organization & Environment, 33(4), 554-574.

7. Bakry, W., Mallik, G., Nghiem, X. H., Sinha, A., & Vo, X. V. (2023). Is green finance really “green”? Examining the long- run relationship between green finance, renewable energy and environmental performance in developing countries. Renewable Energy, 208, 341-355.

8. Su, X., Razi, U., Zhao, S., Li, W., Gu, X., & Yan, J. (2025). Geopolitical risk and energy markets in China. International Review of Financial Analysis, 104187.

9. Monk, A., & Perkins, R. (2020). What explains the emergence and diffusion of green bonds?. Energy Policy, 145, 111641.

10. Sreenu, N. (2025). Examining the dynamics of risk associated with green investment in India: a study on fintech and green bonds for clean energy production. Journal of Economic Studies, 52(3), 588-604.

11. World Bank. (n.d.-b). Environment, Social and Governance data [Data set]. World Bank Databank

12. Caldara, D., & Iacoviello, M. (2022). Measuring geopolitical risk. American economic review, 112(4), 1194-1225.

13. World Bank. (n.d.). World Bank Databank.

14. Seabold, S., & Perktold, J. (2010). Statsmodels: econometric and statistical modeling with python. SciPy, 7(1), 92-96.

15. Sheppard, K. (2024). Linear Models for Panel Data (Version 5.3).

16. DiMaggio, P. J., & Powell, W. W. (1983). The iron cage revisited: Institutional isomorphism and collective rationality in organizational fields. American sociological review, 48(2), 147-160.

17. Luo, L., & Qi, C. (2022). The tendency of terrorist organizations to explosive attacks: An institutional theory perspective. Frontiers in psychology, 13, 747967.

18. Kahupi, I., Yakovleva, N., Okorie, O., & Hull, C. E. (2024). Implementation of Circular Economy in a Developing Economy’s Mining Industry Using Institutional Theory: The Case of Namibia. Journal of Environmental Management, 368, 122145.

19. Zhao, R. R., Wang, Q., Tian, Y., & Chen, Q. H. (2023). Explaining the stability of cooperation in agricultural industry chains based on the institutional theory: Multiple mediating effects of perceived value and trust. Frontiers in Psychology, 13, 1094879.

20. De Bock, T., Scheerder, J., Theeboom, M., Constandt, B., Marlier, M., De Clerck, T., & Willem, A. (2022). Stuck between medals and participation: an institutional theory perspective on why sport federations struggle to reach Sport- for-All goals. BMC Public Health, 22(1), 1891.

21. Rechsteiner, R. (2021). German energy transition (Energiewende) and what politicians can learn for environmental and climate policy. Clean technologies and environmental policy, 23, 305-342.

22. Fu, W., & Irfan, M. (2022). Does green financing develop a cleaner environment for environmental sustainability: economies. Frontiers in Psychology, 13, 904768.

23. Abbas, J., Wang, L., Belgacem, S. B., Pawar, P. S., Najam, H., & Abbas, J. (2023). Investment in renewable energy and electricity output: Role of green finance, environmental tax, and geopolitical risk: Empirical evidence from China. Energy, 269, 126683.

24. Chishti, M. Z., Dogan, E., & Binsaeed, R. H. (2024). Can artificial intelligence and green finance affect economic cycles?. Technological Forecasting and Social Change, 209, 123740.

25. Van Niekerk, A. J. (2024). Economic inclusion: green finance

and the SDGs. Sustainability, 16(3), 1128.

26. Gandhi, H. H., Hoex, B., & Hallam, B. J. (2025). Private equity renewable energy investments in India. Heliyon, 11(1).

27. Grumann, L., Madaleno, M., & Vieira, E. (2024). The green finance dilemma: No impact without risk–a multiple case study on renewable energy investments. Green Finance, 6(3), 457-483.

28. Zhang, D., Chen, X. H., Lau, C. K. M., & Cai, Y. (2023). The causal relationship between green finance and geopolitical risk: implications for environmental management. Journal of Environmental Management, 327, 116949.

29. Patel, R., Kumar, S., Bouri, E., & Iqbal, N. (2023). Spillovers between green and dirty cryptocurrencies and socially responsible investments around the war in Ukraine. International Review of Economics & Finance, 87, 143-162.

30. Qamruzzaman, M., & Karim, S. (2024). Green energy, green innovation, and political stability led to green growth in OECD nations. Energy Strategy Reviews, 55, 101519.

31. Bakkar, Y., Jabeur, S. B., Mohammed, K. S., & Arfi, W. B. (2024). Environmental transition dynamics under external conflict risk: New evidence from European countries. Journal of Cleaner Production, 472, 143510.

32. Ameli, N., Dessens, O., Winning, M., Cronin, J., Chenet, H., Drummond, P., ... & Grubb, M. (2021). Higher cost of finance exacerbates a climate investment trap in developing economies. Nature Communications, 12(1), 4046.

33. Yüksel, S., Eti, S., Dinçer, H., Meral, H., Umar, M., & Gökalp, Y. (2025). A novel fuzzy decision-making approach to pension fund investments in renewable energy. Financial Innovation, 11(1), 18.

34. Rehman, M. U., Nautiyal, N., Zeitun, R., Vo, X. V., & Ghardallou, W. (2025). The resilience of green bonds to oil shocks during extreme events. Journal of Environmental Management, 378, 124685.

35. Rao, A., Lucey, B., Kumar, S., & Lim, W. M. (2023). Do green energy markets catch cold when conventional energy markets sneeze?. Energy Economics, 127, 107035.

36. Sen, C., & Chakrabarti, G. (2024). Exploring the risk dynamics of US green energy stocks: A green time-varying beta approach. Energy Economics, 139, 107951.

37. Polat, O., Ozcan, B., ErtuÄ?rul, H. M., Atılgan, E., & Özün, A. (2024). Fintech: A Conduit for sustainability and renewable energy? Evidence from R2 connectedness analysis. Resources Policy, 94, 105098.

38. Knesl, J. (2023). Automation and the displacement of labor by capital: Asset pricing theory and empirical evidence. Journal of financial economics, 147(2), 271-296.

39. Kartun-Giles, A. P., & Ameli, N. (2023). An introduction to complex networks in climate finance. Entropy, 25(10), 1371.

40. Manzli, Y. S., Fakhfekh, M., Béjaoui, A., Alnafisah, H., & Jeribi, A. (2025). On the hedge and safe-haven abilities of bitcoin and gold against blue economy and green finance assets during global crises: Evidence from the DCC, ADCC and GO-GARCH models. PloS one, 20(2), e0317735.

41. Hanif, W., El Khoury, R., Arfaoui, N., & Hammoudeh, S. (2025). Are interconnectedness and spillover alike across green sectors during the COVID-19 and the Russia Ukraine conflict?. Energy Economics, 144, 108293.

42. Mertzanis, C. (2023). Energy policy diversity and green bond issuance around the world. Energy Economics, 128, 107116.

43. Tunn, J., Müller, F., Hennig, J., Simon, J., & Kalt, T. (2025). The German scramble for green hydrogen in Namibia: Colonial legacies revisited?. Political Geography, 118, 103293.

44. Athari, S. A., & Kirikkaleli, D. (2025). How do climate policy uncertainty and renewable energy and clean technology stock prices co-move? evidence from Canada. Empirical Economics, 68(1), 353-371.

45. Bashir, M. A., Qing, L., Razi, U., Xi, Z., & Jingting, L. (2025). A green leap forward: Environmental efficiency amidst natural resource and technological shifts. Renewable and Sustainable Energy Reviews, 216, 115686.

46. Bhattacharyya, R. (2022). Green finance for energy transition, climate action and sustainable development: overview of concepts, applications, implementation and challenges. Green Finance, 4(1), 1-35.

47. Chai, S., Chu, W., Zhang, Z., Li, Z., & Abedin, M. Z. (2025). Dynamic nonlinear connectedness between the green bonds, clean energy, and stock price: the impact of the COVID-19 pandemic. Annals of Operations Research, 345(2), 1137- 1164.

48. Cheng, X., Dou, W. W., & Liao, Z. (2022). Macroâ?finance decoupling: Robust evaluations of macro asset pricing models. Econometrica, 90(2), 685-713.

49. Dong, X., & Huang, L. (2024). Exploring ripple effect of oil price, fintech, and financial stress on clean energy stocks: A global perspective. Resources Policy, 89, 104582.

50. Jabeur, S. B., Bakkar, Y., & Cepni, O. (2025). Do global COVOL and geopolitical risks affect clean energy prices? Evidence from explainable artificial intelligence models. Energy Economics, 141, 108112.

51. Jamaldin, S., & Mithu, A. (2024). Capital Asset Pricing Model (CAPM) Analysis of Tanzanian Public Firms. Journal of Policy and Development Studies, 17(1), 168-180.

52. Ko, H., & Lee, J. (2025). Portfolio Management Transformed: An Enhanced Black–Litterman Approach Integrating Asset Pricing Theory and Machine Learning. Computational Economics, 1-47.

53. Kurov, A., Wolfe, M. H., & Gilbert, T. (2021). The disappearing pre-FOMC announcement drift. Finance research letters, 40, 101781.

54. Latif, Y., Shunqi, G., Fareed, Z., Ali, S., & Bashir, M. A. (2023). Do financial development and energy efficiency ensure green environment? Evidence from RCEP economies. Economic research-Ekonomska istraživanja, 36(1), 51-72.

55. Lehnert, T. (2023). Environmental policy and equity prices. Plos one, 18(7), e0289397.

56. Li, B., Amin, A., Nureen, N., Saqib, N., Wang, L., & Rehman,

M. A. (2024). Assessing factors influencing renewable energy deployment and the role of natural resources in MENA countries. Resources Policy, 88, 104417.

57. Moro, K. D., Xi, J., Fumey, M. P., Awuye, S. K., & Sackitey,

G. M. (2025). Industrialization, energy demand and environmental pollution nexus in MINT economies. Does cleaner energy transition and environmental technology play a mitigating role?. Journal of Environmental Management, 376, 124451.

58. Nawaz, M. A., Seshadri, U., Kumar, P., Aqdas, R., Patwary,

A. K., & Riaz, M. (2021). Nexus between green finance and climate change mitigation in N-11 and BRICS countries: empirical estimation through difference in differences (DID) approach. Environmental Science and Pollution Research, 28, 6504-6519.

59. Organisation for Economic Co-operation and Development. (n.d.). OECD Data [Data set].

60. Pedregosa, F., Varoquaux, G., Gramfort, A., Michel, V., Thirion, B., Grisel, O., ... & Duchesnay, É. (2011). Scikit- learn: Machine learning in Python. the Journal of machine Learning research, 12, 2825-2830.

61. Protter, P. (2022). Continuous-time asset pricing theory.

62. Qing, L., & Alnafrah, I. (2025). Environmental attention in cryptocurrency markets: A catalyst for clean energy investments. International Review of Economics & Finance, 99, 104063.

63. Rojo-Suárez, J., & Alonso-Conde, A. B. (2020). Relative Entropy and Minimum-Variance Pricing Kernel in Asset Pricing Model Evaluation. Entropy, 22(7), 721.

64. Rojo-Suárez, J., & Alonso-Conde, A. B. (2020). Impact of consumer confidence on the expected returns of the Tokyo Stock Exchange: A comparative analysis of consumption and production-based asset pricing models. PloS one, 15(11), e0241318.

65. Taquet, V., Blot, V., Morzadec, T., Lacombe, L., & Brunel, N. (2022). MAPIE: an open-source library for distribution-free uncertainty quantification. arXiv preprint arXiv:2207.12274.

66. Vigo-Pereira, C., & Laurini, M. (2022). Portfolio Efficiency Tests with Conditioning Information—Comparing GMM and GEL Estimators. Entropy, 24(12), 1705.

67. Xiao, C., & Tabish, R. (2025). Green Finance Dynamics in G7 Economies: Investigating the Contributions of Natural Resources, Trade, Education, and Economic Growth. Sustainability, 17(4), 1757.

68. Yuan, X., Qin, M., Zhong, Y., & Nicoleta-Claudia, M. (2023). Financial roles in green investment based on the quantile connectedness. Energy Economics, 117, 106481.